Embark Small Cap Equity Fund (ESCWX) Strategy Profile

April 02, 2024| Share Class | Institutional |

| Cusip | 41152J405 |

| Fund Number | 2047 |

| Net Expense Ratio* | 0.69% |

| Gross Expense Ratio | 0.85% |

| Inception Date | 01/30/2024 |

| Manager Name | Harbor Muti-Asset Solutions Team |

| Initial NAV | $10.00 |

| Benchmark | Russell® 2000 Index |

| Morningstar Category | Small Cap Blend |

*The net expense ratios for this fund are subject to a contractual management fee waiver and/or an expense limitation agreement excluding interest expense and acquired fund fees and expenses (if any) through 02/28/2025.

Diversified Small Cap Exposure. ESCWX utilizes a model portfolio of seven active small cap subadvisors with differentiated styles, philosophies and specializations, enabling strong diversification and alpha potential.

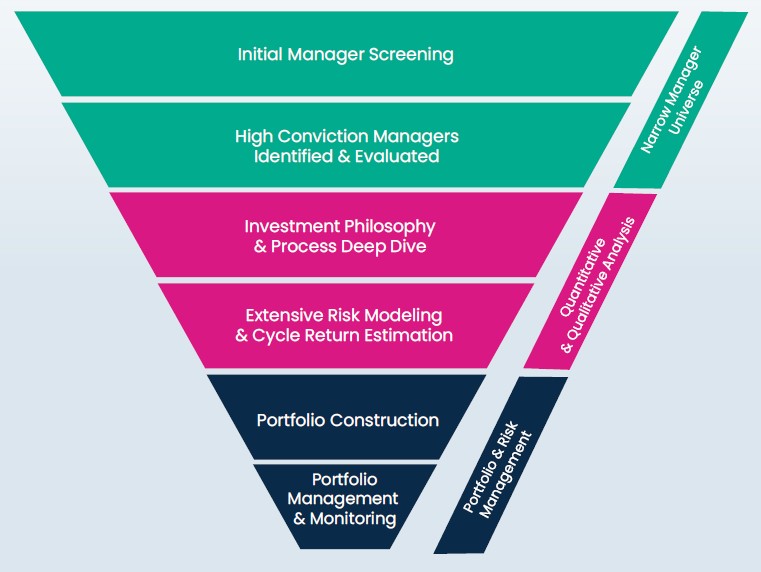

Manager Selection Expertise. ESCWX’s underlying subadvisors have been selected via Harbor’s compelling and time-tested Alpha Edge framework, a process in which subadvisors and investment strategies are chosen based on the results of a rigorous and robust evaluation.

Risk Managed. Harbor’s Multi-Asset Solutions Team (MAST) aims to optimize the diversification benefits of ESCWX’s underlying subadvisors, seeking to minimize factor risks and enable security selection to principally drive portfolio returns.

All-Weather Approach. Strategy is tailored to seek alpha across varying market conditions given the diverse nature of ESCWX’s underlying subadvisors and MAST’s portfolio construction and risk management process.

The Embark Small Cap Equity Fund seeks long-term growth of capital and is an actively managed Fund that invests primarily in equity securities, principally common stocks of small cap companies. Under normal circumstances, the Fund invests at least 80% of its net assets, plus borrowings for investment purposes, in securities of small cap companies.

The Fund employs a multi-manager approach to achieve its investment objective. The Fund’s investment advisor, Harbor Capital Advisors, Inc. is responsible for selecting and overseeing investment subadvisors for the Fund. The subadvisors are responsible for providing the advisor with a model portfolio, which the advisor will implement in its discretion in managing the Fund.

The Advisor is responsible for determining the allocation of the Fund’s assets among the subadvisors’ strategies. The Advisor will adjust those allocations over time based upon its qualitative and quantitative assessment of each strategy and how those strategies work in combination to produce idiosyncratic alpha (i.e. returns resulting from stock selection rather than shifts in the broader market) that compounds over time. Under normal circumstances, the Advisor expects to review the allocations to the subadvisors’ strategies quarterly.

| Copeland Capital Management: A Growth-at-a-Reasonable-Price (GARP) strategy focused on quality businesses that have the potential to grow their dividend and retain the ability to reinvest in the business for future growth. |

| Shapiro Capital Management: Searches for established businesses focusing on event-driven catalysts and idiosyncratic opportunities – Contrarian, Spin-Off Related Opportunities, and Reorganizations. |

| Granahan Investment Management: A growth strategy that utilizes a fundamental investment approach that is focused on a company’s Life Cycle. The portfolio is comprised of companies bucketed into Early-Stage, Core, and Special Situations groups. |

| Hotchkis & Wiley Capital Management: A benchmark agnostic value strategy seeking to identify market inefficiencies that create opportunities to buy businesses that are undervalued relative to long-term earnings potential. Focused on long-term earnings potential, using normalized earnings and return on equity reversion. |

| Reinhart Partners: A value-leaning portfolio comprised of quality, durable businesses, seeking to mitigate downside risk in challenging and volatile markets. Specialized focus on private market valuations. |

| Punch & Associates Investment Management: High conviction portfolio that blends value and growth. Focused on identifying high quality businesses that are lesser-known, misunderstood, or going through a transition. Emphasis on profitability, durable business with competitive barriers to entry and well capitalized businesses with excess liquidity. |

| Westfield Capital Management: A GARP investment style focused on deep fundamental due diligence that seeks to identify underappreciated earnings growth trading at reasonable valuations. |

| Subadvisor | Holdings Range | Portfolio Exposure |

| Copeland Capital Management | 50-80 | Low Volatility / Dividend Growth |

| Shapiro Capital Management | 20-35 | Core Value |

| Granahan Investment Management | 30-70 | Emerging Growth |

| Hotchkis & Wiley Capital Management | 50-80 | Deep Value |

| Reinhart Partners | 35-45 | Quality Value |

| Punch & Associates Investment Management | 30-50 | Core |

| Westfield Capital Management | 50-70 | Quality Growth |

| MAST delivers actionable investment insights and builds multi-asset portfolios and client solutions. The team’s investment platform combines proprietary quantitative and qualitative signals with inputs from Harbor's Investment Research Team, subadvisory network, and other sources to guide investment decisions across asset allocation, portfolio management, and risk oversight. |

Each subadvisor is responsible for providing MAST with a model portfolio, which they then will implement in its discretion in managing the Fund. MAST is responsible for allocating the Fund’s assets among each subadvisor's strategy as well as implementing each strategy (which includes buying and selling securities as recommended by each subadvisor).

Each subadvisor has its own process for identifying and evaluating companies and will act independently from the other subadvisors. A subadvisor will generally identify securities for its model portfolio by analyzing issuers based on factors such as financial performance, industry position, growth expectations or other investment considerations. A subadvisor will remove securities from its model portfolio for which its outlook has changed or when it has identified more attractive investment prospects.

Important Information

All investments involve risk including the possible loss of principal.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. The Fund’s performance may be more volatile because it invests primarily in issuers that are smaller companies. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, government sanctions, social and economic risks. Because the Fund is managed pursuant to model portfolios provided by non-discretionary Subadvisors, the Advisor may effect trades less frequently than if the Fund employed discretionary subadvisors that effected trades for the portfolio directly. As a result, a trade may be less advantageous for the Fund than it would have been if it were implemented at the time the Subadvisor included it in its model portfolio, and that could cause the Fund’s return to be lower. The Subadvisors’ investment styles and security recommendations may not always be complementary, which could affect performance.

Diversification does not assure a profit or protect against loss in a declining market.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000® and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Growth Index and Russell® are trademarks of Frank Russell Company. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Alpha is a measure of risk (beta)-adjusted return.

Growth at a reasonable price (GARP) is an equity investment strategy that combines growth and value investing attributes. GARP investors focus on companies with earnings growth above broad market levels but without extremely high valuations.

Return on Equity (ROE) is the measure of financial performance calculated by dividing net income by shareholders' equity. Calculated as weighted average.

ROE reversion suggests return on equity will eventually return to it’s long-term mean or average.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

QSR-09072025-6461939.1.1

3583563