Global Equity Outlook

The Dominance of Acronyms

April 26, 2024

According to Harbor’s subadvisor C WorldWide, the first quarter of 2024 saw a rise in focus on generative artificial intelligence (Gen AI) and on obesity drug makers, as well as the performance of those companies, sectors and regions tied to these themes. C WorldWide’s Investment Report for the first quarter of 2024 included the following outlook that touched on these themes and more.

“Although we think it is too early to call off the risk of recession and predict a clear sky outlook, the current trends look surprisingly strong.”

Recent equity returns have been dominated by two acronyms — Gen AI and GLP-1. The trend of polarized equity markets has continued, driven by these two significant developments. This is centered on the promises of artificial intelligence and the wonder drugs combatting obesity from the class of Glucagon-Like Peptide-1 marketed by the two pharmaceutical companies Novo Nordisk and Eli Lilly.

The group of AI stocks has been synonymous with “The Magnificent Seven”; however, in 2024, it could be appropriate to rename it to the “Fantastic Few” as only three of the seven have generated significantly superior returns in Q1, with Apple and Tesla yielding negative returns. The share price of Nvidia, in particular, has been exceptional, with a Q1 return of approx. 80% driven by the demand for the company’s GPU (graphics processing unit) products powering the new AI-driven LLMs (Large Language Models). The huge investments in GPU chips have had positive effects on the whole semiconductor supply chain, including TSMC (the leading manufacturer of high-performance semiconductors) and ASML (the leading provider of semiconductor lithography equipment).

“The huge investments in GPU chips have had positive effects on the whole semiconductor supply chain, including TSMC.”

Also benefitting from the Gen AI boom, from a longer-term perspective, are Cloud service providers like Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP). These three companies represent 66% of the worldwide cloud infrastructure market which we believe represents a long-term, lower- risk way of gaining exposure to the AI revolution.

Within GLP-1, Novo Nordisk and Eli Lilly are driving the new obesity treatment paradigm. The share price of Novo Nordisk rose approx. 25% in Q1, driven by a strong product uptake, superior production capacity and positive news about a promising phase 1 next-generation product, thereby lessening concerns about patent expirations of current products. The power of the GLP-1 trend has made Novo Nordisk from Denmark the most valuable company in Europe.

“We would argue that there are structural trends underpinning some of the (ultra) large companies as the network effect can produce very high marginal profitability benefitting especially digital companies.”

The power of size and scale

Given these trends, the US, together with its technology leadership, continued to outperform European equities, and, in the US, large-cap companies outperformed small-caps, with the S&P500 outperforming the Russell 2000 by more than 500 bps. Many observers argue that the rally of large-cap stocks is unsustainable. However, we would argue that there are structural trends underpinning some of the (ultra) large companies as the network effect can produce very high marginal profitability benefitting especially digital companies. Given that AI will create new business opportunities and drive cost savings, access to and owning data will become an increasingly competitive factor. Here again, the large companies control most of the data. This is also the case within the more traditional industrial sectors, where automation and intelligence will play a key role. Finally, large companies possess more knowledge and infrastructure to better navigate in a world that is becoming increasingly multipolar.

Economy versus long-term investing

The current economic environment looks favorable, with declining inflation and governments continuing to support their economies. Europe remains weak but hopes for interest rate cuts are supportive. In China, the government is implementing several liquidity and fiscal support packages to stimulate the sluggish economy. The US remains strong despite relatively high-interest rates as fiscal support reaches unprecedented levels. The Biden administration appears committed to maintaining a strong economy, with limited discussions on either side of the political spectrum to reduce fiscal deficits.

We and many other observers expected a weaker economy especially in the US, given the rapid and strong tightening of monetary policy in both Europe and the US starting more than 20 months ago. The lagging transmission of monetary policy changes is well understood and is the key argument for a weaker growth outlook in 2024. Although we think it is too early to call off the risk of recession and predict a clear sky outlook, the current trends look surprisingly strong, with consensus expecting lower policy rates and continued decent growth. This scenario is supportive of real assets, including equities.

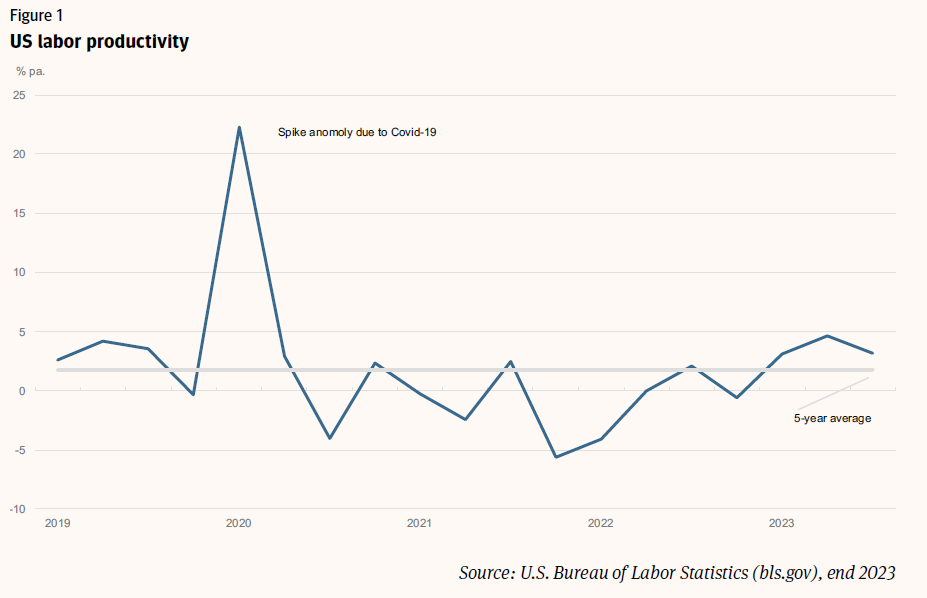

One encouraging data point with long-term implications is the recent pick-up in US labor productivity, as seen above in Figure 1, where the recent three quarters have posted annualized productivity gains above 3%. This compares to the historical average over the last 5 years of 1.8% per annum. In the short term, the productivity data is rather volatile and somewhat susceptible to changes in hours worked; however, the trend should be followed closely as the promise of Gen AI is exactly higher productivity. Higher productivity brings many benefits, including higher corporate margins, rising labor income that supports economic growth and increased demand without higher inflation.

“We continue to see many attractive opportunities that are supported by thematic tailwinds.”

This being said, predicting the short- to medium-term market outlook is not our primary focus. As longer- term investors, we look through economic and market cycles and try to find the best structural companies with an attractive risk/return risk profile. In this respect, we continue to see many attractive opportunities that are supported by thematic tailwinds. We have a constant pipeline of investment candidates that we compare with existing holdings. It’s about competition for capital with a five to ten-year perspective. We think intellectual resources and analytical efforts are best allocated to this principle.

Important Information

The views expressed herein are those of C WorldWide at the time the comments were made. These views are subject to change at any time based upon market or other conditions, and the author/s disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

S&P 500 Index features 500 leading U.S. publicly traded companies, with a primary emphasis on market capitalization.

Russell 2000 Index is a market index comprised of 2,000 small-cap companies.

3537769