March FOMC: All’s Well if Inflation Ends Well

March 25, 2024

Executive Summary:

- The Federal Open Market Committee (FOMC) left rates unchanged as expected while delivering an optimistic forecast.

- Lower inflation is achieved without a material increase in unemployment or any slowdown in growth. Despite Powell’s insistence to the contrary, this outlook is not a world in which policy remains restrictive.

- The big bet here is that high inflation in January reflected seasonality issues more than a shift in underlying inflation. Furthermore, the Federal Reserve’s (Fed) internal forecast for February Personal Consumption Expenditures (PCE) is low relative to consensus.

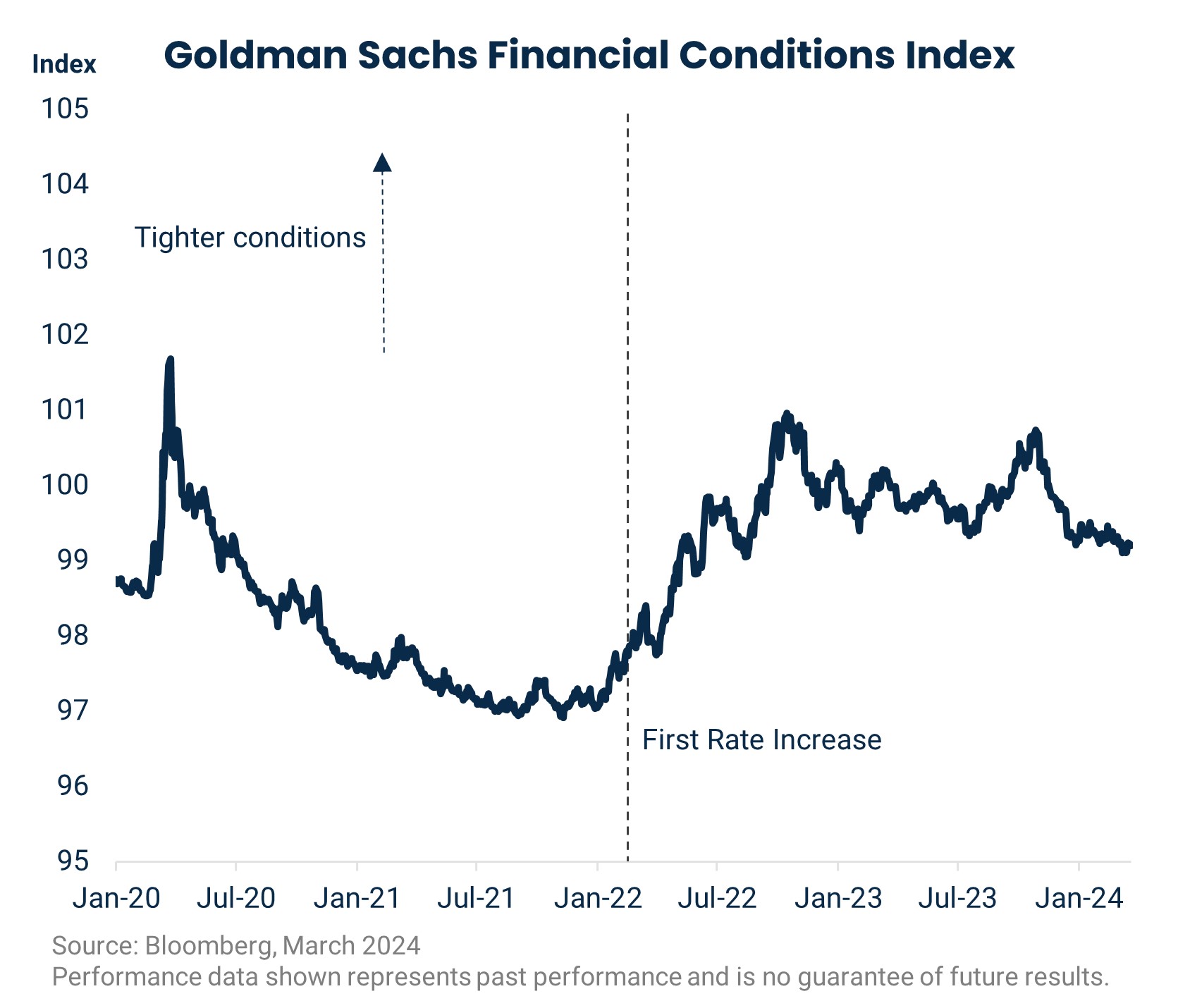

- The positive response in markets is justified if the FOMC is right on inflation, but the risk to markets is becoming more asymmetric given the easing in financial conditions year-to-date and the benign inflation forecast.

The FOMC maintained the target range for the federal funds rate as expected, keeping the focus on the Summary of Economic Projections (SEP) and Powell’s press conference. The SEP retained 3 cuts in 2024, while one cut was removed from 2025. Ahead of the meeting, it was close to 50/50 whether the dots would imply 2 or 3 cuts in ’24, making the result an incremental positive. Beyond 2025, the terminal rate in 2026 now stands at 3.1 percent, a significant gap to the Committee’s estimate of the long-run dot of 2.6 percent. The fate of the long-run dot and its connection to the FOMC’s views on the neutral rate continue to be fodder for questions during the press conference. However, Chair Powell continues to emphasize the uncertainty around estimates for neutral with the implication that views surrounding it are not relevant for policymaking in the near-term.

Focus on the economic forecasts centered on the 2024 estimate for core PCE which increased from 2.4 to 2.6 percent. The increase was on the low end of estimates given the high inflation prints for January and February. Using consensus estimates for February PCE, the 2.6 percent forecast implies a material slowing in the monthly pace of inflation through year-end. The inference is that the Committee viewed the January and February inflation data as more noise than signal, consistent with leaving the statement language on inflation unchanged. Powell said as much during the press conference when asked about the January data when he cited seasonal adjustment factors as the culprit. For February, he offered up the staff’s Core PCE forecast at ‘well below 30 basis points,’ which is on the optimistic end of street forecasts for the print at the end of the month.

The significant upgrade to their outlook for growth was another positive. Real Gross Domestic Product (GDP) is expected to increase by at least 2 percent over the next 3 calendar years, above the long-run forecast for 1.8 percent. Combine that with a flat unemployment rate, this is a soft landing. Chair Powell and the Committee continue to describe policy as restrictive, but there is little evidence for that in either their forecast or the impulse to financial conditions since December. All of this is internally consistent if inflation is slated to decline without aggregate demand slowing, which has been the Committee’s bet for some time. The assumption is that the inflation that followed the pandemic owed more to supply issues in labor and product markets than aggregate demand.

Markets have come around to this idea, with support from positive growth surprises along the way. As a result, we think risks are becoming more asymmetric. We think the most likely outcome is for inflation to fall close enough to the Fed’s target by year-end and for growth to hum along. However, the price for protection in case growth slows is attractive. The choice asset depends on whether growth slows as a byproduct of tighter policy in response to higher inflation or something else. We continue to hold gold for its ability to protect against either scenario.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

The Goldman Sachs Financial Conditions Index is a weighted average of short-term interest rates, long-term interest rates, the trade-weighted dollar, an index of credit spreads, and the ratio of equity prices to the 10-year average of earnings per share.

Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

3473694