Quantix Q2 2023 Newsletter

August 02, 2023

It has been a year where little has gone as investors expected. The much-anticipated recession has, at least as of yet, failed to materialize. As a result, projected rate cuts keep moving further out in time as central banks in the US and around the world continue hawkish rhetoric to tame inflation. Another US debt ceiling stand-off dominated headlines in May but ended up passing without fireworks. The US regional bank crisis never escalated, though fear of future tighter credit conditions looms.

In spite of all of these macro headwinds, the tech-focused Nasdaq 1001 was up 32% in the first half of 2023, its best first half since 19822. This again wasn’t quite what investors expected. Performance was concentrated in certain themes, such as A.I., and in a select handful of equities. The broader S&P 5003 was up 16%, while an equally weighted version of that index was only up +5%.

Commodity markets remained challenging throughout the second quarter, despite what appeared to be constructive fundamentals and a positive long-term story that remains in place. These challenges can be traced to unexpected results from key commodity regions. Events (and subsequent policy responses) in China, Russia and the United States have all helped to confound commodity investors.

The extent of the Chinese reopening has disappointed investors, not providing the anticipated demand for certain commodities. In Russia, the flow of oil was not impacted by sanctions to the extent that was expected, leading to greater supply. In the US, continued interest rate hikes have led to what Goldman Sachs has called a “Great De-Stocking” with a reduction in both physical commodity inventories and financial speculative positions. There are reasons to believe all three of these factors may be significantly less impactful in the second half of the year. We discuss each of the three situations in detail below.

The China Re-Opening Disappointment

Chinese economic growth has significantly underperformed forecasts in recent months. The Asian economy was expected to experience strong expansion during its “re-opening” from the 2022 COVID- related lockdowns. However, this period has turned out to be more about a social re-opening than a true economic expansion. Much like the rest of the world, services and transportation-fuel demand did increase but manufacturing lagged. This theme of a “bi-furcated” economy is most readily apparent in the relative performance of different components within the Petroleum sector. This is something which is easily missed by those investors who simply observe only the WTI Crude Oil benchmark.

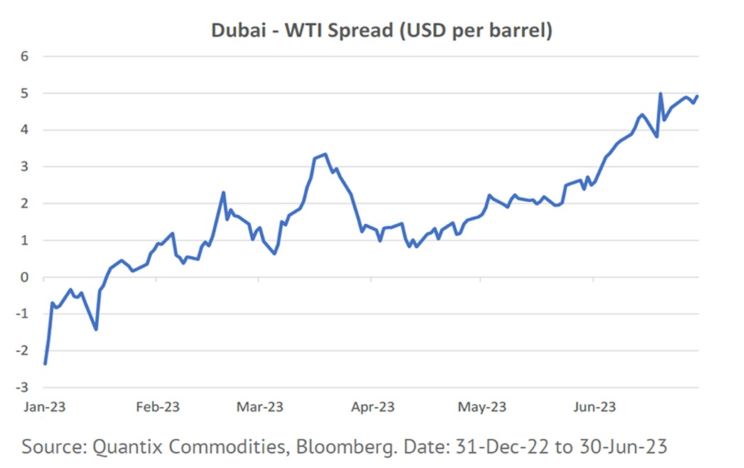

Weak manufacturing has led to low petro-chemical prices, while transportation fuels remain relatively well supported. Similarly, there has been an associated divergence in different grades of crude oils, depending on the types of refined product they yield. To illustrate, Naptha, a petro-chemical feedstock, has significantly underperformed jet fuel so far this year, while Dubai, a distillate rich sour crude, has significantly outperformed the light-sweet WTI crude benchmark. The chart below shows the premium of Dubai to WTI which has been steadily increasing.

The recent Chinese decision to impose export restrictions on rare earth metals, crucial for the semi-conductor and electric vehicle industries, is also noteworthy. It is further evidence of the deglobalization trend (which Quantix has written about in previous newsletters) that we anticipate will continue to generate costly inefficiencies in supply chains, inevitably resulting in higher commodity prices.

Russian Supply Continued To Surprise

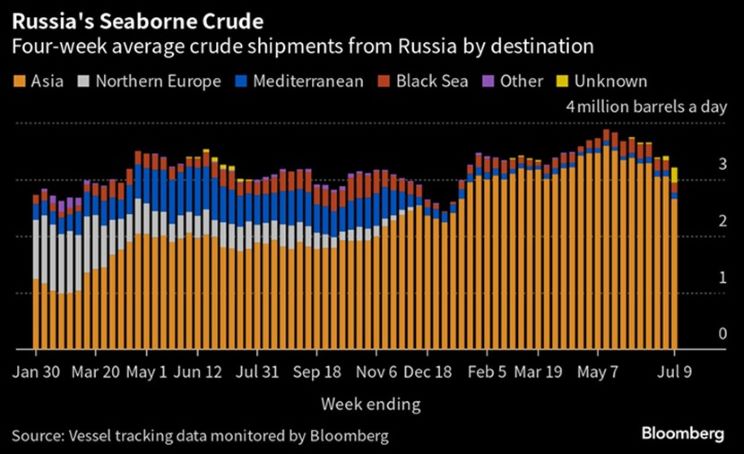

International sanctions, which were expected to create supply shortages in the first half of the year, did not stop the flow of Russian oil as alternative supply routes were quick to emerge. Chinese and Indian refiners were able to opportunistically source Russian barrels to feed their refineries and often at significant discounts to international prices.

To put this in context, Russian exports were expected to drop by over 1.5 million barrels per day (mpbd) from an average of 7.8 mpbd4 in December 2021. However, this never happened, as Russian crude and products still made their way to the market through different paths.

In fact, the need to finance the war effort likely reduced Russia’s commitment to their agreement with OPEC+ supply cuts, turning the conflict from a bullish-oil expectation to a bearish-oil reality.

The dynamics of Russian commodity supply are unlikely to be as accommodative going forward. Firstly, at recent levels of Russian oil production, there is little-to-no possibility of surprising with greater than expected supply. In fact, export data from June is finally showing signs of the promised OPEC+ cuts to Russian supply. Secondly, the possibility of supply disruptions due to the Russia-Ukraine war is now increasing.

Paradoxically, the prolonged stalemate in the conflict has actually created pseudo-stability in commodity markets. It is now the case that a resolution in either direction will likely lead to increased volatility. A Russian “victory” in any form in the Ukraine will not mean the end to instability in the region, and the commitment to permanently remove Russian commodities from western markets will likely only intensify.

It is also difficult for us to conceive of a scenario of Russian capitulation that is also not disruptive to commodity markets. The recent “24-hour coup” could be a sign of longer-term destabilization in a country that is still the world’s second largest oil producer. This could have serious implications. As an example of the extreme effects of political instability and lack of investment, Venezuela was once a major global supplier with the world’s largest oil reserves, yet their exports are significantly off historic highs.

All Out Inflation Fighting In The U.S.

The US Federal Reserve’s commitment to fight inflation has led to what Goldman Sach’s research division has dubbed the “Great De-Stocking”. In commodity markets, this has resulted in a significant decline in long positions in both physical and financial commodity markets.

In physical markets, governments globally have released over 250 million barrels of oil from Strategic Petroleum Reserves, and the US stockpile is now just 347 million barrels5, which is a 40-year low. Energy Aspects, a well-respected oil research firm, believes high financing costs have more broadly discouraged storage across supply chains and reduced supplies in many critical fuels.6

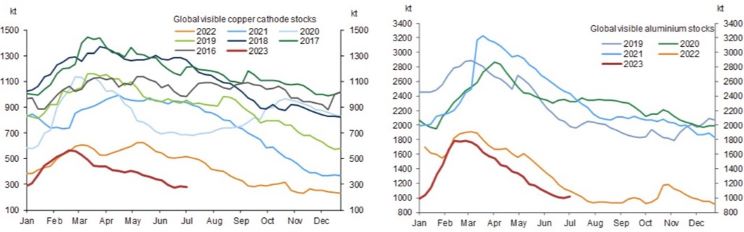

This phenomenon is also evident in base metal markets where visible inventories in Chinese copper (left) and aluminum (right) are also at historic lows.

Source: Goldman Sachs Investment Research, “Metals: What’s going on?”, 07-Jul-23

In financial markets, interest rate hikes have also triggered a massive unwind in the financial positions of commodity market speculators. The fear of demand destruction brought on by the as-yet “anticipated” recession has led to substantial selling of commodity derivatives.

According to Quantix’s proprietary monitors, long investments in Crude Oil derivatives is in the 3rd percentile of the last three years and remains at levels similar to the depths of pandemic lockdowns. More broadly, Goldman Sachs research7 recently estimated that assets invested in total commodity indexes are down to levels last seen in the 2000s, while Citibank Commodity research8 estimates that overall commodity investment is 23% lower than this point last year. At current levels of participation, financial market participants simply don’t have much left to sell!

The low level of inventory in many commodity markets and complete lack of long speculative positions has put the world in a potentially vulnerable spot to respond to any unexpected supply disruptions.

Our Outlook For Key Commodity Sectors

Despite a challenging first half of the year, Quantix is very optimistic for commodity markets for the remainder of 2023. The poor market performance has challenged the faith of many investors, leading to sizable outflows in the space, yet the outlook for most commodity sectors remains supportive.

Petroleum

At the beginning of 2023, even most oil bulls were not expecting a tight petroleum market until the second half of the year. As I often comment, commodity markets largely reflect the spot economics. They are not anticipatory assets like equities.

We are now at that point in oil markets where the anticipated deficits are starting to materialize. It is perhaps not a coincidence that WTI has rallied 7% to a three-month high9 in the first eight days of the third quarter. The relative strength of eastern crudes is now expected to support the benchmarks that could see new 2023 highs in coming months.

Natural Gas

As a sign of underinvestment, the gas storage and transportation infrastructure has failed to keep pace with the growing natural gas supply/demand. As a result, seasonal dislocations have been severe and will continue to be so. This is particularly true in Europe where supply risks are still very real for the upcoming winter despite concerns about oversupply in the short term. Even in the US, low prices are starting to influence producer behavior. While production is still at all-time highs, rig counts have started to roll over. Longer-term the addition of additional LNG export capacity should add additional support for the sector.

Grains

Grains markets transition to trading a new crop year at this point in the calendar. While new crop balances are broadly expected to be less tight than last year, there is still possibility for substantial price appreciation, especially in Soybeans and related products given the surprisingly low planted acreage. Just a one standard deviation10 decline in predicted Soybean yields (which is still quite possible given remaining weather scenarios) could cause Soybean stocks/use ratios to fall to the lowest level in 10 years.

Livestock/Softs

Due to their relatively low weight in the Bloomberg Commodity Index11, the performances of these sectors are often overlooked. But there is little to no bear market here. Cocoa, Sugar, and Feeder Cattle (+31%, +27%, +18% respectively) were the top performing commodities through the first half the year12. Macroeconomic speculation is less relevant in these smaller commodities and the strong micro commodity fundamentals are more readily apparent. These are attractive returns even for a NASDAQ investor!

Base Metals

Many base metals have declined to levels in the cost curves that have traditionally provided strong support, and Chinese stimulus should also help buoy the sector. However, the greatest tailwind for base metals remains the longer-term energy transition theme where projected deficits meet ambitious goals, signaling the potential for significant price appreciation.

Emissions

The second quarter was mostly a story of relative value in emission markets. California markets (CCAs) rallied 6% while European markets (EUAs) declined 3%13. This is consistent with Quantix’s view that California carbon prices will likely converge to European levels over time as the historic oversupply of CCAs is burnt off either through time or regulatory action.

Conclusion

We believe that the modern nature of global commodity markets, with government policy in disparate commodity regions interacting with the physical logistics of supply and demand, creates opportunities for skilled investors. For many of the reasons discussed above, recent events have not quite turned out the way investors expected. However, Quantix expects the second half of the year to be different and result in the return of more active markets.

Important Information

All investments involve risk including the possible loss of principal.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

Quantix Commodities LP is the subadvisor for the Harbor Commodity All-Weather Strategy ETF and the Harbor Energy Transition Strategy ETF.

1 The Nasdaq 100 is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index.

2 Financial Times, “Nasdaq records best start to a year in four decades”, 30 June 2023

3 The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

4 IEA.com, “Oil Market & Russian Supply”

5 SPGlobal.com, “Republican bill conditioning US Strategic Petroleum Reserve releases clears House” 27 January 2023

6 Energy Aspects, “Medium-term and Long-term energy market outlooks

7 Goldman Sachs Investment Research, “The great ‘de-stocking’”, 23 May 2023

8 Citibank Research, “AUM declines should stabilize and remain well-off the 2022 peaks”, 10 July 2023

9 Source: Bloomberg

10 Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The standard deviation is calculated as the square root of variance by determining each data point's deviation relative to the mean.

11 The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Index Services Limited, that tracks prices of futures contracts on physical commodities on the commodity markets.

12 Source: Bloomberg

13 Source: Bloomberg

3030047