Unconventional Times

August 27, 2021

Today’s unconventional times are challenging conventional wisdom. Will the bulls continue to win out over the bears? For investors, there’s lots to consider. U.S. financial markets experienced another surprisingly strong month of performance in June. The post-pandemic economic boom has been driven by the unleashing of pent-up demand, limited supply of many goods, ultra-low interest rates, and a torrent of fiscal and monetary stimulus. The old adage of “too much money chasing too few goods” inevitably drives valuations to new heights. The unprecedented lockdowns resulted in a modest 3.5% contraction in U.S. GDP; however, many companies altered their business models not only to survive, but to enhance profitability. Investors continue to shrug off the recovery impediments of sharply rising oil prices, supply chain bottlenecks, and labor shortages amid a hostile geopolitical environment for business. The wildcard in the markets remains the timing and magnitude of changes to the Federal Reserve’s monetary policy. While most indicators appear to be improving, investors should be more concerned about inflation, slower GDP growth, and a resurgence of the COVID virus. We are living in unconventional times, where conventional wisdom is being challenged.

TRENDING TOPICS

The dominant concern in the markets for the balance of the year is likely inflation, which erodes purchasing power and undermines valuations. History has shown that once inflation takes root in the economy, it becomes difficult to control. Several prominent economists are forecasting that U.S. inflation rate may hit 5% by year-end.

The depth and breadth of these pressures seem unprecedented as consumers have found sharply rising costs in a wide variety of industries and products. The top-line PCE (personal consumption expenditures) figure of 3.9% in May understates massive spikes in the cost of consumer items such as used cars (+29.7%), airline fares (+24.1%), jewelry (+14.7%), bicycles (+10.1%), and footwear (+7.1%). New home prices have also been affected as the high price of lumber added $36,000, on average, to the cost of building a new home. With inflation now outpacing wage gains, real average wages are now actually declining, which could also spur workers to demand higher pay, further exacerbating the inflation spiral.

In addition to cost increases, the Fed has also boosted money supply by 31% since December 2019, while federal spending has risen 50%. Combined with the proposed spending initiatives of the new Biden Administration, the “money machine” seems poised to remain in high gear. Let’s just hope the Fed, as the lender of last resort, knows when to apply the brakes!

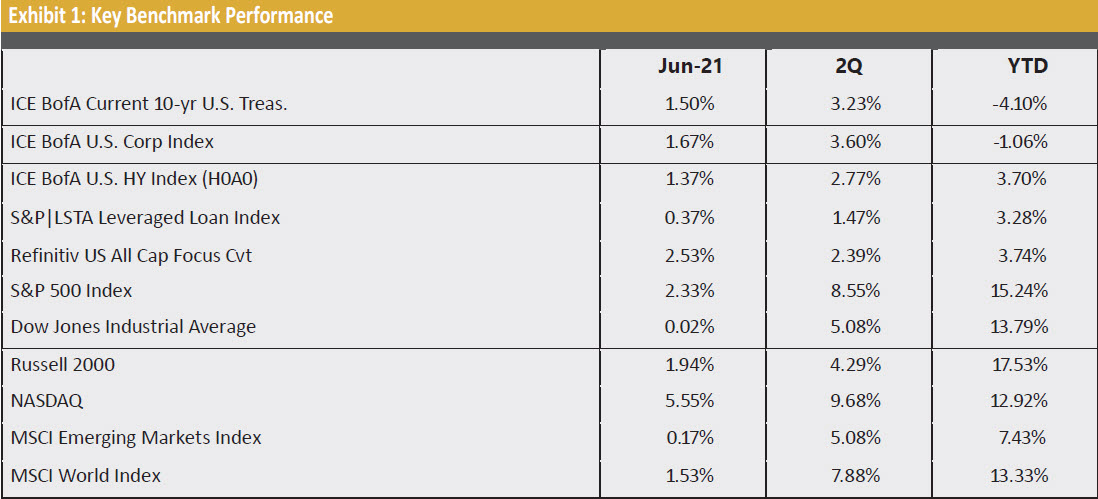

Exhibit 1 illustrates performance for various indices in June, 2Q, and YTD.

ECONOMIC UPDATE

The U.S. economy continues to show favorable momentum as market sentiment remains largely positive. Rate fears have been tempered while investors seem to increasingly view inflation as transitory, not persistent.

Consumer sentiment reached a pandemic high in June with respondents viewing the labor market and the overall economy positively. The Conference Board’s index rose to 127.3 in June from an upwardly revised 120 in the previous month. The report also showed 54.4% of consumers viewed jobs as “plentiful,” the highest level in 21 years, highlighting the glut of 9.2 million job openings.

Although sentiment has risen, personal spending stalled in May, remaining unchanged after increasing by a revised 0.9% in April, according to the Commerce Department. The continuing mass vaccination program should boost confidence further among consumers to resume pre-pandemic activities such as travel.

Activity in the U.S. manufacturing sector slowed modestly, with the ISM factory index declining to 60.6 in June from 61.2 in May. Persistent backlogs, supply chain constraints, and labor shortages continue to weigh on growth in the sector. The report also highlighted the surge in raw material costs, with the index of prices paid rising to 92.1 in June, the highest level since 1979.

The ISM services gauge declined to 60.1 in June from the record 64 in May. In a trend reversal from the past year, restaurant dining, travel, and hotel stays have seen strong demand in recent months, yet these sectors have been among the hardest hit by labor shortages. Order backlogs for service industries also hit the highest level since 1997, further contributing to the squeeze.

HIGH YIELD MARKET

With interest rate and inflation fears subsiding, the high yield market experienced the sharpest monthly gain of the year, pushing the H0A0 yield-to-worst to a record low of 3.83% on June 29th. The average of the five major high yield indices rose 1.26% in June to finish the quarter with a gain of 2.69%, bringing the year-to-date return to 3.77%.

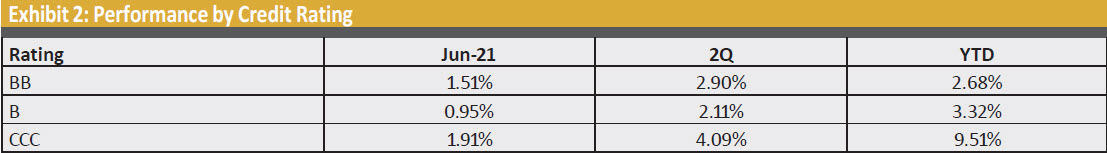

Credit rating returns continued to show the risk-on theme of previous months with CCCs posting the largest gains, though by an ever-narrowing margin. A reduced focus on rate fears helped buoy BBs during the month.

Exhibit 2 highlights performance by rating for the ICE BofA U.S. High Yield Index (H0A0).

High yield bond issuance subsided in June but still posted the third-highest quarterly volume on record (behind 1Q-21 and 2Q-20). In the second quarter, $140.5 billion of new high yield bonds came to market bringing the year-to-date total to $299.1 billion, according to JPMorgan Research. This represents a 37% increase compared to the same period last year.

The leveraged loan market underperformed its fixed income peers in June as focus shifted from rates amid robust primary market activity. The S&P|LSTA Leveraged Loan Index rose 0.37% in June, closing the quarter with a gain of 1.47%, bringing the year-to-date return to 3.28%.

Leveraged loan issuance rebounded in June as $71.8 billion came to market, after a comparatively modest $47.4 billion in May. On a year-to-date basis, loan issuance totals $494.9 billion gross, $186.2 billion net, an increase of 102% and 141%, respectively, versus the same period last year.

High yield analysts and portfolio managers will need to recalculate their financial models due to new tax laws taking effect in January 2022. The after-tax costs for many high yield issuers may rise next year based upon how much interest they can deduct. The current interest expense deductibility cap is 30% of EBITDA, but as of January 1st, depreciation and amortization will be removed from the calculation. According to a Barclay’s report, of the issuers with public financials, 28% would exceed the new cap, raising their borrowing costs.

MARKET OUTLOOK

The bond market is often seen as a barometer of future inflation and economic growth. Over the past several decades, yields have risen in anticipation of higher inflation. Hence, predicting the rate of inflation may be the most impactful decision for investors over the next year.

Two powerful drivers of inflation are higher wages and energy prices. Once these forces become imbedded into the fabric of the economy, the transitory effect may become more permanent, with ripple effects across most industries.

Markets are telegraphing that a curtailment in the Fed’s $120 billion monthly asset purchasing program should be prolonged, and two 25 basis point rate hikes may be delayed into late 2022.

One key question is how long America can keep borrowing without serious consequences. Conventional wisdom would dictate that an avalanche of debt could diminish the value of the dollar and drive rates higher. However, during these unconventional times, the old principles of economics and finance may no longer be applicable.

The seismic shift in global macro policy over the last 40 years could lead to greater market volatility. The infusion of extraordinary monetary and fiscal stimulus into the economy has created distortions with unknown future consequences. As a result, many investors are looking for the next big investment idea.

Leveraged finance investors should continue to ride the wave of low rates, benign defaults, and a vibrant primary market. If the equity markets experience a change in sentiment toward profit-taking, the high yield bond and loan markets should experience less volatility and offer compelling relative value. Again, we are living in unconventional times! In the current environment, what investment advisors may want to consider are active strategies that not only seek to maximize returns but also minimize risk.

Legal Notices & Disclosures

All charts and data are for illustrative purposes only.

Views expressed herein are drawn from commentary provided to Harbor by the subadviser, Shenkman Capital Management, Inc., and may not be reflective of their current opinions or future actions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

The information provided in this article should not be considered as a recommendation to purchase or sell a particular security. The weightings, holdings, industries, sectors, and countries mentioned may change at any time and may not represent current or future investments. Performance data shown represents past performance and is no guarantee of future results.

Shenkman is an independent subadviser to the the Harbor Convertible Securities Fund and the High-Yield Bond Fund.

*Redistributed with Shenkman permission.

For Institutional Use Only. Not for Distribution to the Public.