When the Facts Collide With Conventional Wisdom

May 14, 2021

Looking at the environment for active managers, I generally try and evaluate two things:

- How many active managers are outperforming (opportunity) and

- What is the dispersion between stronger performing managers and weaker performing managers (reward)?

Conventional wisdom

When looking at active management, conventional wisdom goes a little something like this:

- The more liquid the asset class, the more efficient price discovery becomes

- The more efficient price discovery is, the more efficient the asset class becomes

- The more efficient the asset class becomes, the less opportunity there is to find mispriced securities

- The less mispriced securities there are, the less opportunity there is for active managers to distinguish themselves

- When looked at together, this means that managers in large and liquid pools of public investing cluster together and, in aggregate, look like an expensive index fund, minus active fees

Conventional wisdom indicates the further you move away from large liquid pools of public investing the more likely you are to find inefficiencies. The closer you are to “alternatives” like private equity or hedge funds, the more manager selection matters.

Evaluating the data

As I mentioned above, I believe to try and understand the environment for active managers you need to look at both the number of managers outperforming (opportunity) and how much the winning managers outperform the losing managers (reward).

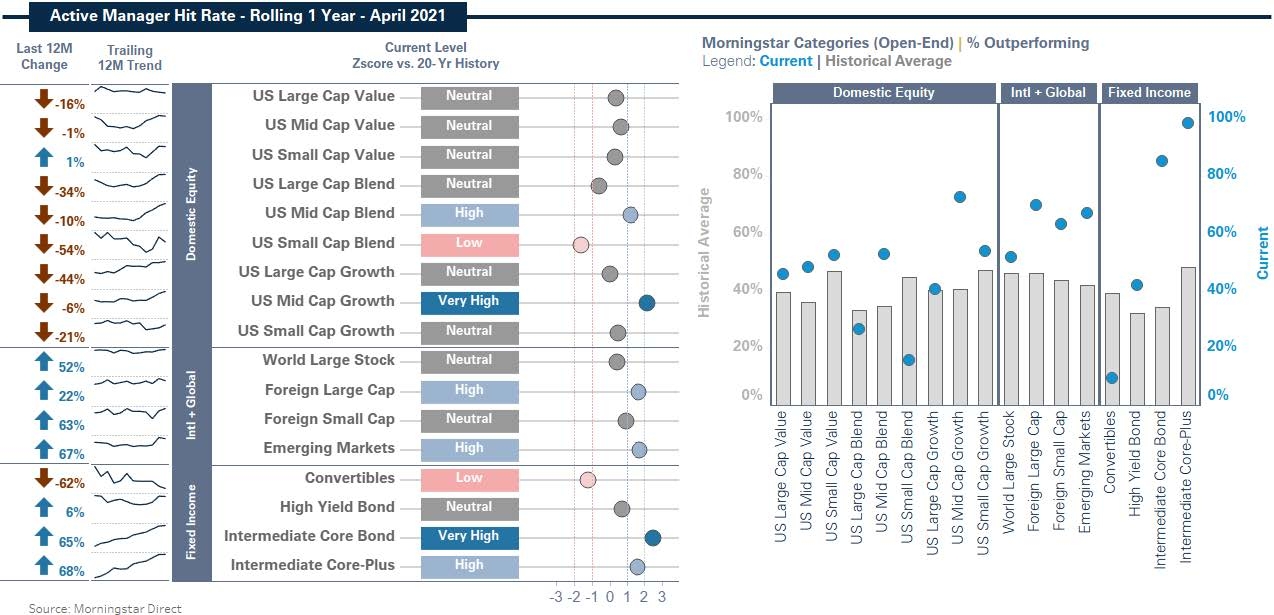

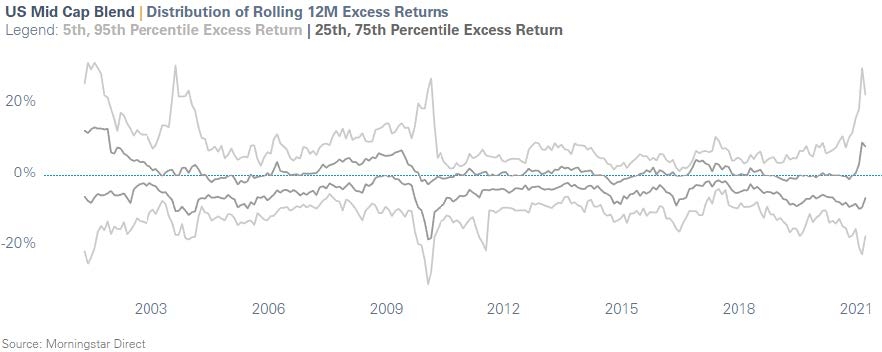

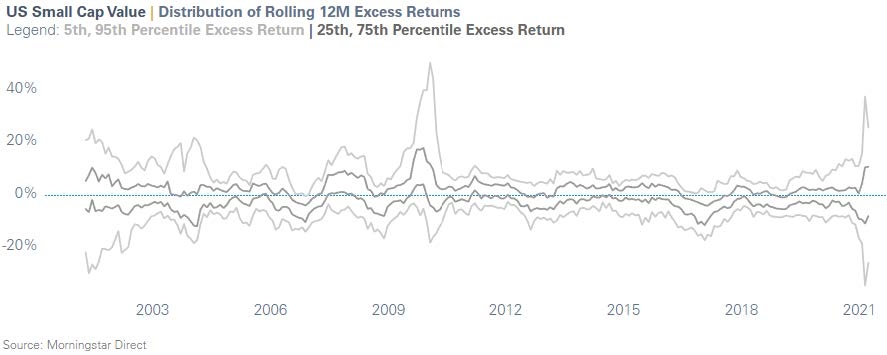

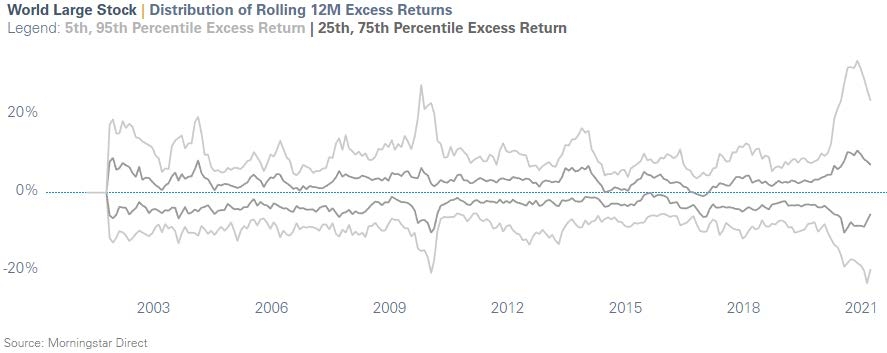

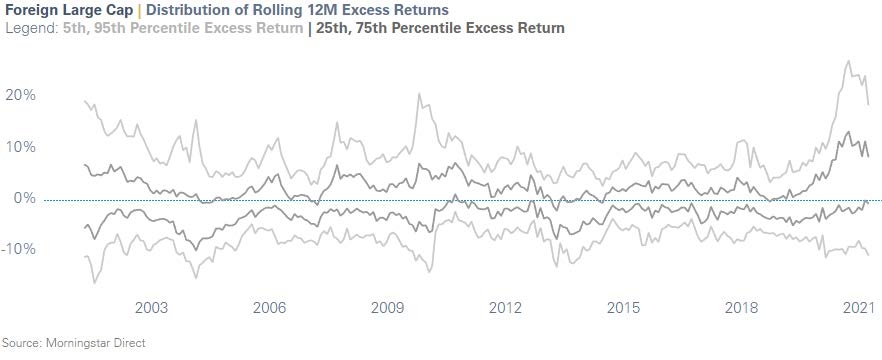

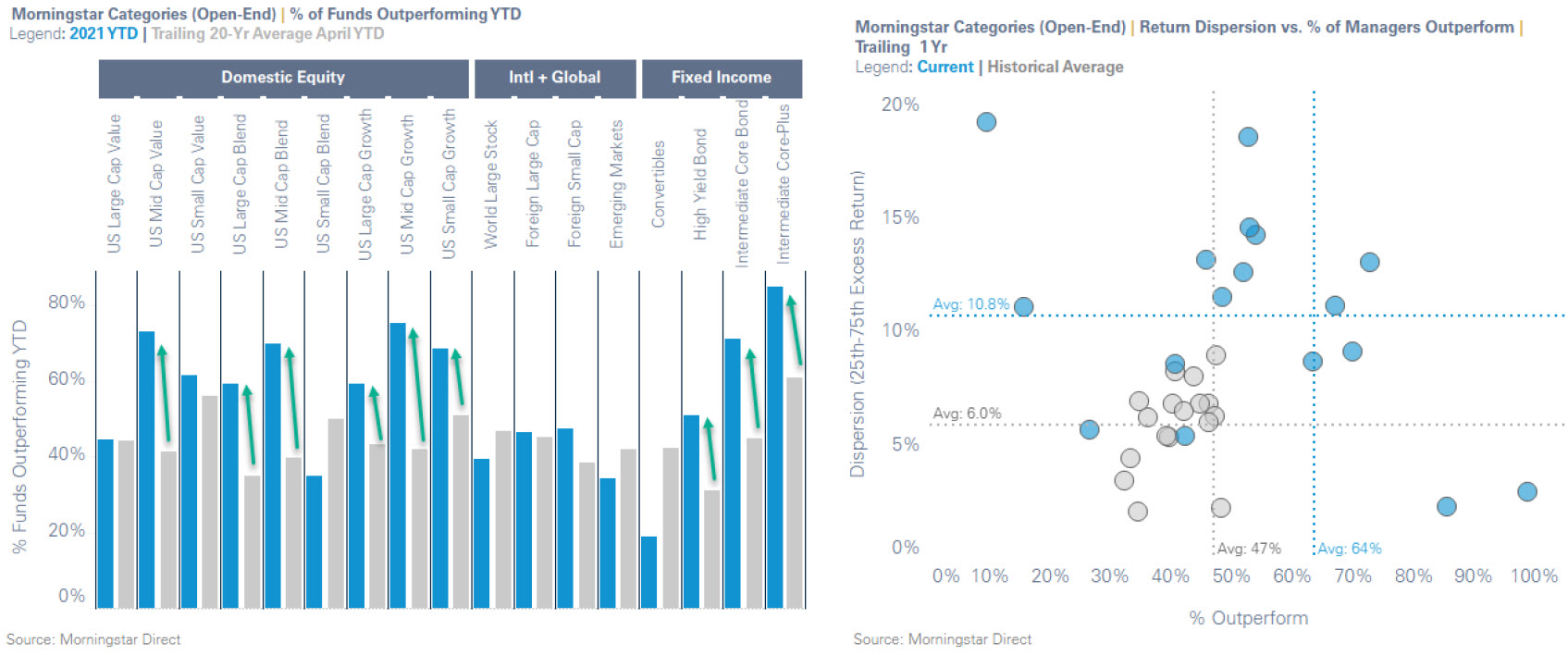

Let’s look at the opportunity of active managers first. Remember, this is the probability of a manager outperforming net of fees. At Harbor, we look at this across every major asset class where we run money - this gauge is reading about average now. These numbers are all trailing 12 months compared to long-term averages (20 years). The following exhibits are all sourced from Morningstar, April 2021, and excess returns are all relative to the assigned Morningstar category benchmark.

Most indicators point to “Neutral.” So far, so boring. The low readings for small cap blend can largely be attributed to the GameStop effect (source: “Long-Term, Short Squeeze,” Kristof Gleich, February 2021) and the convertible bonds, the Tesla effect, have accounted for nearly a quarter of the Indexes return.

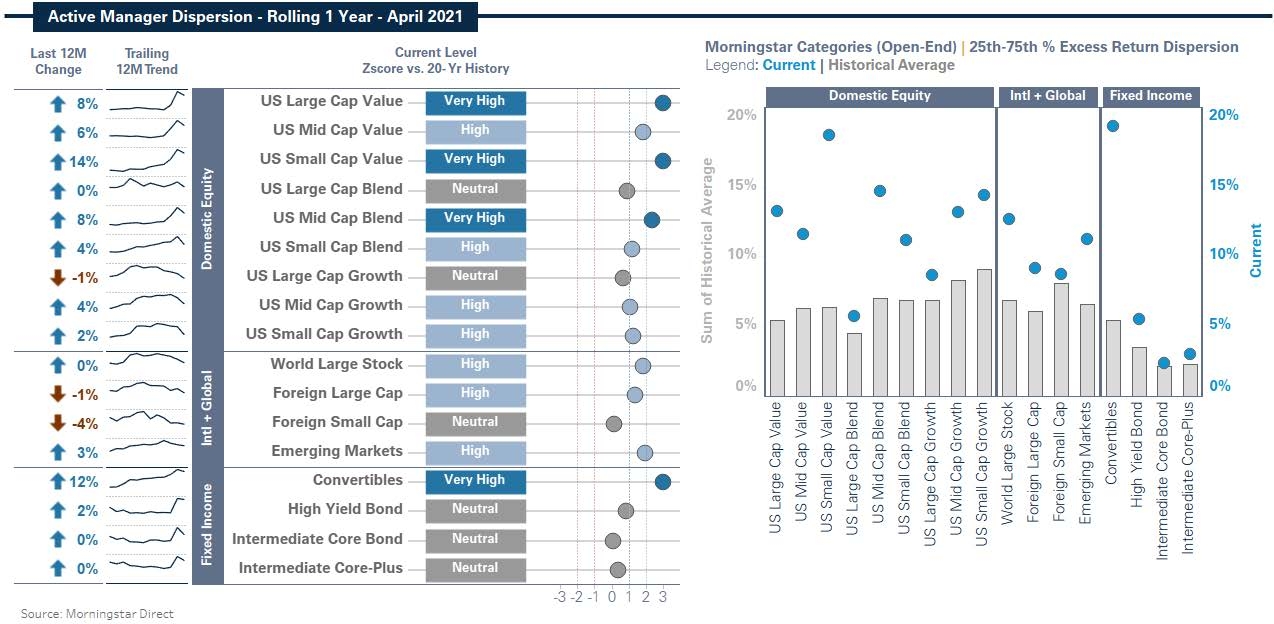

Looking at our dispersion (this is the potential reward of active) indicator is where things start to get very strange. This chart shows how much differentiation there is between managers in these same asset classes:

Most readings are at “Very High” according to Harbor’s gauges. This suggests that currently there is a lot of dispersion between active managers. Interestingly, across the different asset classes we have not seen dispersion like this in the last 20 years. The following are some notable highlights.

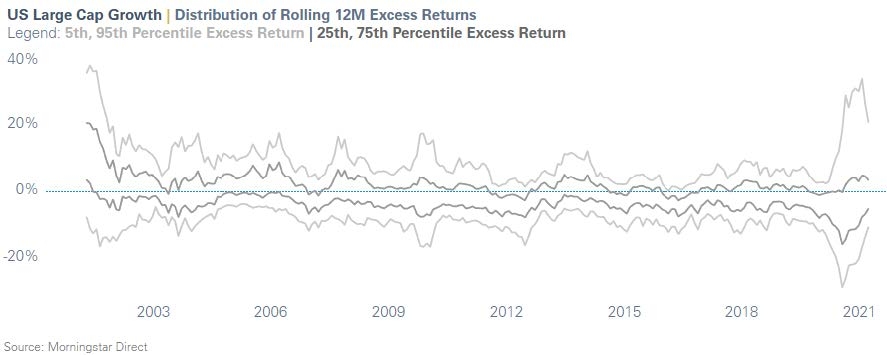

The top 5% of large growth investors are adding more value since the technology bubble of early 2000’s.

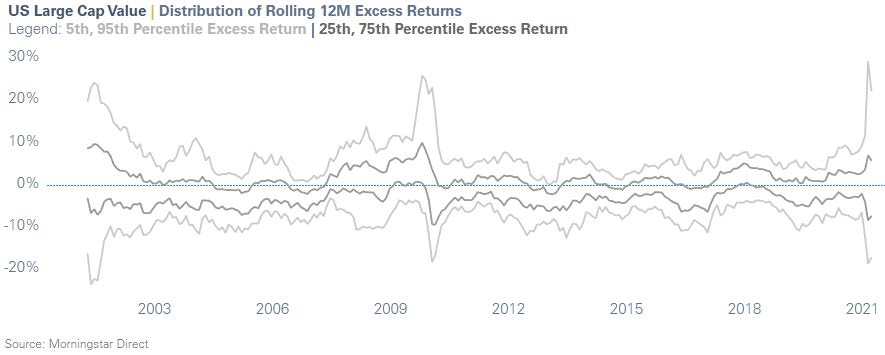

Large value managers have quickly joined the party with value dispersion higher than I’ve ever seen it.

Medium size disruptive innovator names have propelled the success of mid growth managers.

To date, mid value has never seen such a dramatic shift in dispersion.

Small value is only surpassed by the recovery post Global Financial Crisis.

Investing in the widest opportunity set (Global) providing ample opportunities.

I’m seeing top quartile managers now generating more excess returns than the previous top 5% of managers.

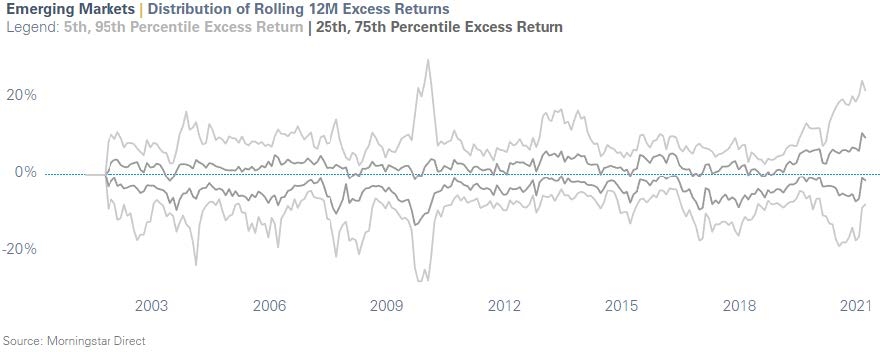

High quality emerging market managers are proving their worth throughout significant emerging market investing uncertainty.

We’re researching more around these findings. We think it is some combination of more favorable stock dispersion (higher), more favorable correlations (generally lower) and larger opportunity set to hit home runs (great proportion of right tail stocks up over 100% relative to the benchmark). As our research develops, we'll report back with additional data and perspective

What is interesting so far this year is that the number of active managers outperforming on a year-to-date basis is quite high compared to where we normally are at this point of the year.

If anything, this trend seems to be accelerating rather than winding down.

Unconventional wisdom

We appear to be in a new macro environment – the post GFC era of macro stability, low but steady growth, disinflation, and highly supportive interest rates and bond yields has ended.

Macro uncertainty and dispersion are as high as I have seen in 20 years of my career. Fiscal policy and monetary policy coordination represent a completely new backdrop facing investors. The recent past is not prologue. Indeed, investors have to look back to the late 1920’s or 1930’s to see a policy environment that most closely mirrors today’s environment. Currency volatility and inflationary fears are creating new complexities we all must navigate. Disruptive innovation, driven by relentless and accelerating technology advances are creating new investment opportunities that have secular growth characteristics with less economic sensitivity – these are creating either new markets entirely or shaking up the market share pie of well-established industries. This environment seems to be creating more value creation and value destruction. Pulling this altogether, perhaps this is bolstering an environment where skilled stock pickers can once again add significant value for clients. We continue to monitor this dynamic for signs of mean reversion or whether we have entered into a different environment altogether.

What should investors do?

In this somewhat unprecedented environment, due diligence around manager selection is critical and active management, including actively managing passive index allocations, continues to be an important way to navigate the changing market landscape.

Expect larger dispersion of returns between your public market active managers while navigating this macro environment.

Recalibrate expectations around returns as the numbers are all over the map.

Look for managers that have higher idiosyncratic returns compared to factor-based returns.

Manager returns are more important in this environment. Higher idiosyncratic returns will likely be less correlated to other sources of returns and therefore likely be more valuable.

Legal Notices & Disclosures

All charts and data are for illustrative purposes only.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

The information provided in this article should not be considered as a recommendation to purchase or sell a particular security. The weightings, holdings, industries, sectors, and countries mentioned may change at any time and may not represent current or future investments. Performance data shown represents past performance and is no guarantee of future results.

© [2021] Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.